Our Loan Sales & Distribution Businesses

It is our belief that commercial real estate lending is increasingly

reliant on whole or component loan sales due to pressures from

shareholders, investment committees, and an ever-changing

economic climate, made worse by the recent events of COVID-19.

Acting as an independent private placement desk, we serve

lenders and investors looking to monetize their positions in A-

notes, Mezzanine Debt and Whole Loans as they deal with

liquidity or credit concerns.

Lotus is equipped with the proven capital markets relationships

and capital structure knowledge to help execute those sales.

Professionals at Lotus consist of sell-side veterans with tested,

decades-long relationships across the capital markets, enabling us

to produce optimal loan sales results. Our principals have

experience placing all components of the capital stack and know

how to run a loan-sales placement process targeted to protect

value. We have a keen understanding of your concerns, speak your

language, and, more importantly, the language of your counter-

party.

- Former Lenders & Loan Structuring Specialists

- Maintain Unmatched Lending Relationships

- Understand What Makes Lenders “Tick”

- Moral Authority & Market Credibility

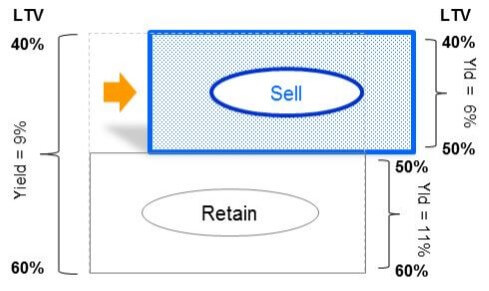

We help place the senior positions of loans on behalf of our lender and investor clients in order to help the address their unique balance sheet needs.

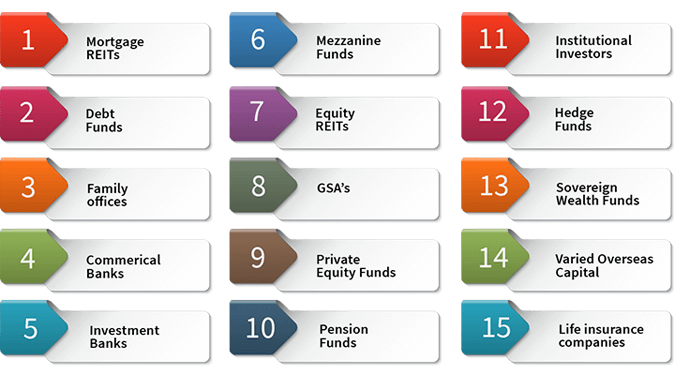

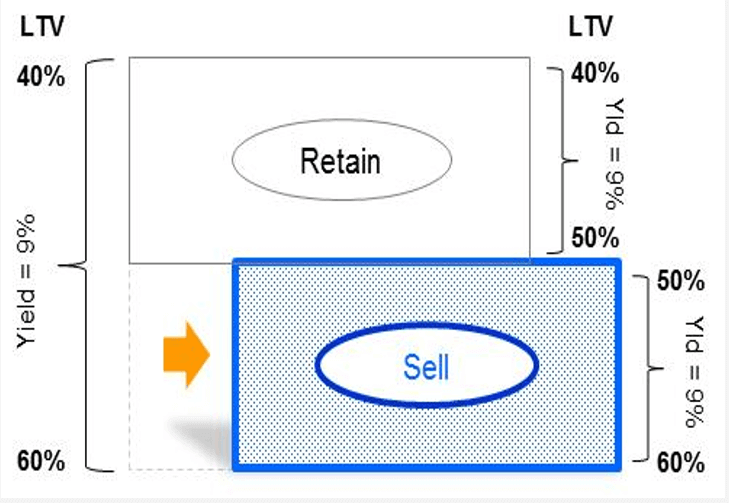

Our relationships with debt and mezzanine funds, mortgage REIT’s, sovereign wealth funds and numerous international pools of capital enable us to provide our clients with a service of selling off mezzanine positions to manage their internal risk profiles.

![]() We Are a “RENTABLE”

Private Placement Desk

We Are a “RENTABLE”

Private Placement Desk

![]() Ww Specialize In The Sales Of A-

Notes, Mezz Debt & Whole Loans

Ww Specialize In The Sales Of A-

Notes, Mezz Debt & Whole Loans

![]() Help Lenders Free Up Capital

OR Enchance Returns

Help Lenders Free Up Capital

OR Enchance Returns

![]() Assist Lenders In Trimming Risk

& Portfolio Concentrations

Assist Lenders In Trimming Risk

& Portfolio Concentrations

1. Capital Relationships

Through our extensive relationships with life companies, banks, and debt funds, we have the in-house capabilities to position our clients senior loans so they can optimize an appropriate leveraged return for their balance sheet risk.