Capital Placement

Our Capital Placement business focuses on arranging capital and providing high quality customized thinking solutions to meet our clients' financing needs.

Overview

Our Capital Placement business focuses on arranging capital and providing high quality customized solutions to meet our clients’ financing needs. This expertise covers debt, mezzanine, and preferred equity financing, as well as, joint-venture equity. These transactions include ground-up development, recapitalizations, stabilized, and transition loans and is source from across the real estate capital markets to deliver the most optimal financing solution for our clients.

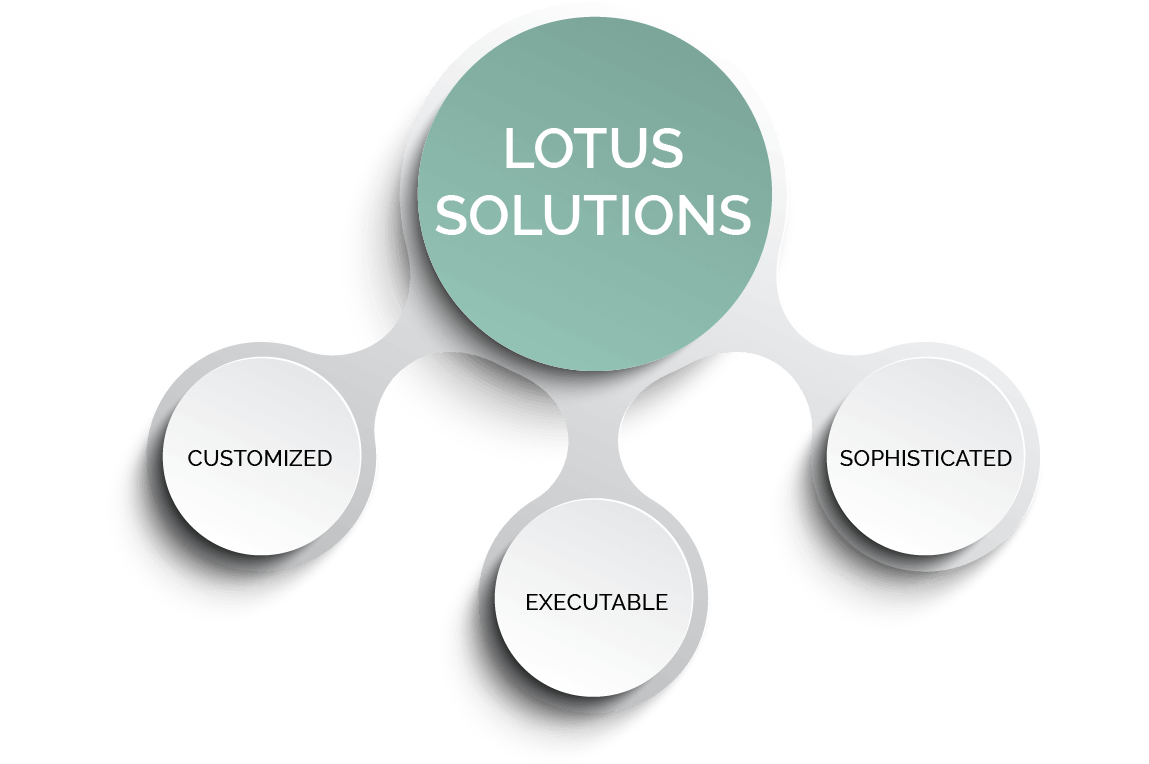

Our Capital Placement business is defined by these 3 factors:

Our Capital Placement Practice

-

Debt Placement for Borrowers

OverviewAt Lotus, our firm strives to provide our clients with innovative solutions and strategies to meet their capital needs. We have extensive experience assisting borrowers on complex structured transactions requiring customized thinking.

What we doSource capital

Who we ServeBorrowers

Our Value Proposition

Product ExpertiseThe capital placement expertise we provide covers debt, mezzanine, and preferred equity financing, as well as, joint-venture equity. These solutions include CMBS, low and high leverage bridge financing, conversion/transitional financing, ground-up construction, and debt solutions arising from joint-ventures and recapitalizations.Capital Markets KnowledgeOur team possesses a rich knowledge of capital markets dynamics. Accordingly, we understand the suitability between the specific transactions we are mandated on and each of the four corners of the real estate capital markets.Strong RelationshipsOur network of relationships underscores two strengths: (1) They span across both the capital structure and the capital markets; and (2) We enjoy deep relationships with a vast network of major capital providers gained through real transactions.Complex DealsOur area of expertise is complex deals that require dedicated attention from seasoned professionals. We take great pride in understanding and helping our clients solve their complex real estate financing issues.Real World ExperienceOur strong differentiator is that our debt placement business is overseen by career lending veterans, not career brokers. We draw our experience from the actual structuring of real estate loans, not solely the interpretation of them. We tell our clients that our value proposition is “making the sale, not attracting the bid."

Product ExpertiseThe capital placement expertise we provide covers debt, mezzanine, and preferred equity financing, as well as, joint-venture equity. These solutions include CMBS, low and high leverage bridge financing, conversion/transitional financing, ground-up construction, and debt solutions arising from joint-ventures and recapitalizations.Capital Markets KnowledgeOur team possesses a rich knowledge of capital markets dynamics. Accordingly, we understand the suitability between the specific transactions we are mandated on and each of the four corners of the real estate capital markets.Strong RelationshipsOur network of relationships underscores two strengths: (1) They span across both the capital structure and the capital markets; and (2) We enjoy deep relationships with a vast network of major capital providers gained through real transactions.Complex DealsOur area of expertise is complex deals that require dedicated attention from seasoned professionals. We take great pride in understanding and helping our clients solve their complex real estate financing issues.Real World ExperienceOur strong differentiator is that our debt placement business is overseen by career lending veterans, not career brokers. We draw our experience from the actual structuring of real estate loans, not solely the interpretation of them. We tell our clients that our value proposition is “making the sale, not attracting the bid."

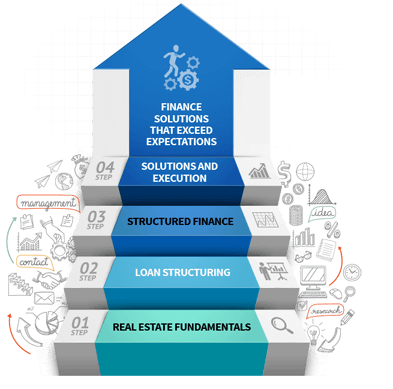

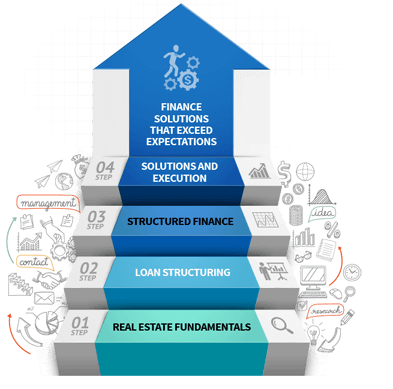

Our Approach

We dedicate significant time to internal technical and fundamental analysis. We utilize that analysis in order to formulate our view of executable outcomes that we share with our clients before we approach the market. We then go to market and leverage our vast network of lenders & investors to source the most attractive outcomes. Clients are then able to evaluate transactional terms from suitable sources.

Debt Placement Process

-

1

Understand Objectives

- Meet with client to understand desired results

- Crunch data and analyze all relevant dynamics so we get the “story”

- Formulate the “pitch”

- Provide client with pulse of capital markets

-

2

Chart Lending Strategy

- Work with client to construct marketing campaign

- Create target list of lenders

- Establish timelines and key milestones

- Internal assessment of terms and an “ask” of the market

-

3

Head to Market

- Create buzz and solicit lender interest

- Establish war room

- Finalize offering materials

- Educate lenders on story, address Q&A, and drive competition

-

4

Compile Initial Bids

- Retrieve bids

- Provide clients with detailed matrix of lender options and terms

- Select initial list of finalists

-

5

Advance Finalist

- Progress negotiations on deal terms

- Liaise with decision makers to drive down execution risk

- Continue to monitor market pulse to independently test lender terms

-

6

Finalize Deal Terms

- Continue negotiation of term sheet

- Conduct final round of discussions for open-items with finalists

-

7

Select Lenders & Initiate Process

- Finalize term sheet

- Re-confirm buy-in from lender leadership

- Initiate kick-off call with all deal participants to establish timing and responsibilities

- Monitor closing process

-

8

Monitor Closely

- Ensure deal parties moving along to established deadline

- Stay ahead of issues and resolve any conflicts on deal complexities

-

9

Seamlessly Executed

1. Product Expertise

The debt placement expertise we provide covers debt placement and mezzanine finance, joint-ventures, recapitalizations and loan sale advisory.

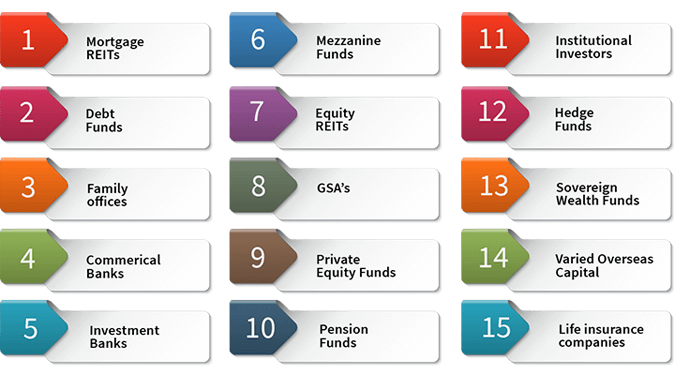

2. Capital Markets Knowledge

Our team possesses a rich knowledge of capital markets dynamics. Accordingly, it understands the suitability between the specific transactions we are mandated on and each of the four corners of the real estate capital markets (see link). We further grasp the underlying forces and market trends that drive each component of these markets.

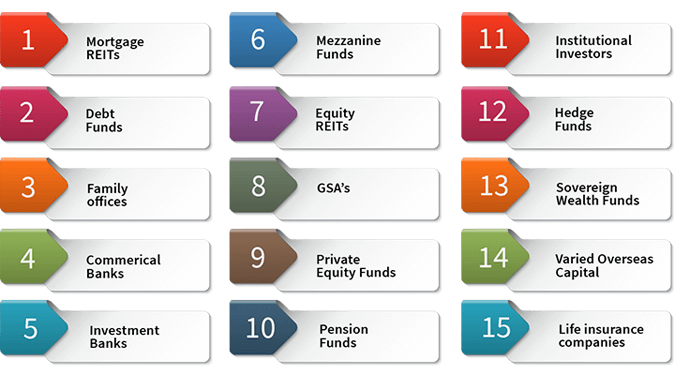

3. Strong Relationships

Our network of relationships underscores two strengths: (1) they span across both the capital structure and the capital markets, and, (2) we enjoy deep relationships with a vast network of major capital providers gained through real transactions

1. Capital Relationships

Through our extensive relationships with life companies, banks, and debt funds, we have the in-house capabilities to position our clients senior loans so they can optimize an appropriate leveraged return for their balance sheet risk.

2. Capital Markets Knowledge

Our services enables holders of debt to access non mark-to-market, uncrossed senior leverage gained through customized strategies ranging from private placement of senior loans to pooling debt placement loans and issuing CLO securities.

3. Technical Skills

We are equipped to handle all aspects of the co-lender/inter-creditor negotiations, rating agency analysis, loan structuring, pooling and servicing agreement, and sales management.